What’s the Difference Between a Cash ISA and a Stocks & Shares ISA?

What is Compound Interest? A Beginner’s Guide That’ll Finally Make It Click

Welcome, my fellow finance fledglings! I’m Tom Bradley—your friendly financial guru who believes that understanding money shouldn’t feel like decoding ancient hieroglyphics. Today, we’re tackling a concept so powerful it’s often dubbed the “eighth wonder of the world” by Einstein himself. Yep, we’re talking about compound interest.

If that term has ever made your eyes glaze over, you’re in the right place. I’m about to break this down in plain English, with a sprinkle of humor and a healthy dose of “ah-ha!” moments. Let’s dive in.

What Is Compound Interest?

Compound interest is essentially interest on interest. Yes, it’s very meta. But in practice, it’s how your money grows in a snowball effect over time, without additional effort from you.

Here’s a simple way to think about it:

If you invest $100 and earn 5% interest per year, you’ll have $105 at the end of the first year. Sweet, right?

But in year two, you don’t earn 5% just on your original $100—you earn it on the full $105. That means you’ll end up with $110.25. The extra $.25 may seem small, but give it decades and we’re talking serious wealth-building potential.

The Math Behind Compound Interest

If you’re a formula fan, here it is:

A = P(1 + r/n)nt

- A = the future value of the investment/loan, including interest

- P = the principal investment amount

- r = the annual interest rate (in decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested

Mathy, I know. But we’ll stick to examples to keep our brains from melting.

Why Compound Interest Matters

Imagine saving for retirement. You start putting aside just $100 a month in your twenties, and your investment earns 7% interest annually. Thanks to compound interest, you’re not just adding $100 each month—you’re letting the interest earn more interest every single year.

After 40 years, you wouldn’t have just $48,000—your total would be closer to $240,000. That’s compound interest in action, and that’s why starting early is pure gold.

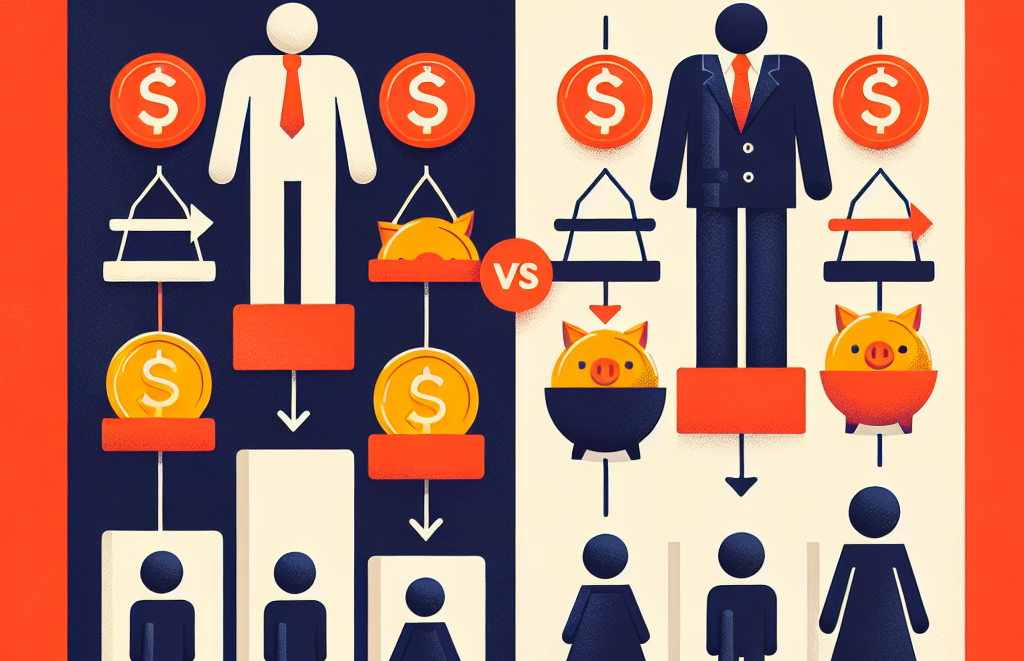

Simple vs. Compound Interest: What’s the Difference?

Let’s do a quick comparison to clear the fog.

Simple Interest

This is calculated only on the original principal. No reinvesting of interest involved.

Compound Interest

This earns you interest on both the principal and the previously earned interest.

Which one do you think builds more money? Hint: compound is the Beyoncé of interest—powerful, enduring, and a crowd favorite.

Real-Life Example: The Tale of Two Friends

Let’s meet Sam and Alex.

- Sam starts investing at age 25, putting $200 a month into an account earning 7% annual interest. He stops at age 35.

- Alex starts at age 35 and contributes $200 a month all the way to age 65.

Who ends up with more money at retirement?

Shockingly, Sam does. Despite investing for only 10 years, the early start allowed compound interest to work its magic for 30 additional years. Alex, while dedicated, couldn’t catch up because time, not timing, is everything in compounding.

Key Terms to Know

Let’s get comfy with a few keywords that’ll pop up often.

- Principal: Your initial amount of money invested/saved.

- Interest Rate: The percentage your money earns annually.

- Compounding Frequency: How often your interest calculates and adds to the balance (annually, monthly, daily).

The more frequent the compounding, the faster your money grows. Daily > Monthly > Annually. Cue happy dance.

How Can You Take Advantage of Compound Interest?

1. Start Early, Even with Small Amounts

In compounding, time is your secret weapon. Start whatever you can afford—even if it’s just $25/month—and let it simmer.

2. Be Consistent

Set up automatic contributions. It’s easier to stay committed when it just… happens without thinking.

3. Reinvest Earnings

Whenever you earn dividends or interest, don’t take the money out to buy another smart speaker. Reinvest it. Remember, this is interest feeding on interest—don’t break the chain.

4. Minimize Withdrawals

Interrupting compounding is like taking your cake out of the oven halfway through. You’ll ruin what could’ve been a rich, delicious result.

Best Tools to Calculate Compound Interest

You don’t need a Ph.D. in finance to do the math. Use one of these free calculators to visualize your growth:

Play around with it. Tweak the interest rate, adjust the deposit amount, and see how your money can grow over time.

Common Mistakes Beginners Make (and How to Avoid Them)

- Waiting too long to start: Don’t wait for a raise, bonus, or divine sign. Starting small is infinitely better than never starting.

- Withdrawing too early: Let the money sit and work for you.

- Focusing only on high returns: Consistency and time offsets fancy investments.

Remember, building wealth is like growing a tree. You water it regularly and let time do the heavy lifting.

Final Thoughts: Compound Interest = Freedom Tickets

When you truly grasp how compound interest works, it’s like unlocking a cheat code to financial freedom. This principle isn’t just for Wall Street wizards—it’s for everyone, and especially for you.

So no matter where you are right now—19 or 59—it’s never too early or too late to start putting compound interest to work. Set your settings to “auto-grow” and let time and interest team up for your future.

Have questions? Want to share your journey? Reach out to us or read more about our mission at About Us.

Until next time, stay curious, stay consistent, and let your money do the hard work!

Leave a Reply